Over the last few weeks, we and our colleagues across the nation have been fielding calls from clients who are asking the kinds of questions that every professional investor hates to hear.

- The Dow has reached (and then fallen back below) 20,000. Should I take money off the table?

- My preferred candidate didn’t win the election, and I think the world is going to hell in a handbasket. Don’t you think I should sell my stocks now before it’s too late?

- The market has had a big run up over the last 8 years and people talk about “if” there’s a bear market going to occur during the Trump Administration?

The first question is the easier one to answer. It seems to be human nature to have a strange fascination with round numbers. Why should Dow 20,000 be any different, from a pure investing standpoint, than Dow 19,774.83 or Dow 20,093.65? The questions about this magic number become even sillier when you realize that the Dow is made up of just 30 out of many thousands of American-based companies.

The rational way to frame the question about taking money off the table is: can you afford to lose some percentage of your assets—and that percentage figure depends on how aggressive is your asset allocation—before the markets recover? Will you have time to recover?

If you’re de-cumulating in retirement, or just approaching retirement, that percentage you can afford to lose will be lower than it would be for a millennial investor or somebody late in retirement. Whatever that amount is, you should look back historically, take a hard look at the darkest days for your particular mix of assets, and note the times it breached that floor. (Hint: check out early 2009.) Then see if you want to change your allocations to something more conservative.

Since your portfolio is designed to withstand a dipping down as you make withdrawals, then you will inevitably be rewarded by new market highs at some point after the bear (and there will be a bear) is over. There will inevitably be a 100% swing in the markets, and you know with absolute certainty in which direction that will be.

As to the second question, the real issue is the eternal question: what’s coming next in the markets? The only truthful answer to that question, however it’s phrased, is: we don’t know. As investors, we need to take that answer very seriously.

After President Obama was elected, financial planners were fielding questions from their angry and frightened conservative clients, who were asking to bail on their stock portfolios in anticipation of the country going to hell in a handbasket. But ask yourself: how did that work out? Those investors would have missed the longest running bull market in memory.

Then, for the last five years at least, the experts were certain that bond rates were just about to rise dramatically, and many professional investors stayed ultra-short to avoid the losses. How did that work out? Bonds stayed where they were for five more years, and those investors missed out on percentage points of additional yield.

For the last four years at least, people have been saying that the current bull market is long in the tooth, what with the markets testing new highs. Over and over they felt like it was a good time to take their winnings off the table. How did that work out? They would have bailed before the markets repeatedly broke record highs.

So now we have a situation where the other half of the country is still reeling from the election results and predicting that the country is going to hell in a handbasket. Advisors are doing everything they can to keep clients from acting emotionally rather than rationally.

This third question is actually totally wrong: The truth is not if, but when the next Bear Market will pounce upon the US stock market! And it won’t necessarily be triggered by a poorly-worded tweet, a global-trade-stopping new tariff regime or tax and entitlement reform. Every presidential cycle has its share of market drawdowns, seemingly regardless of presidential policies.

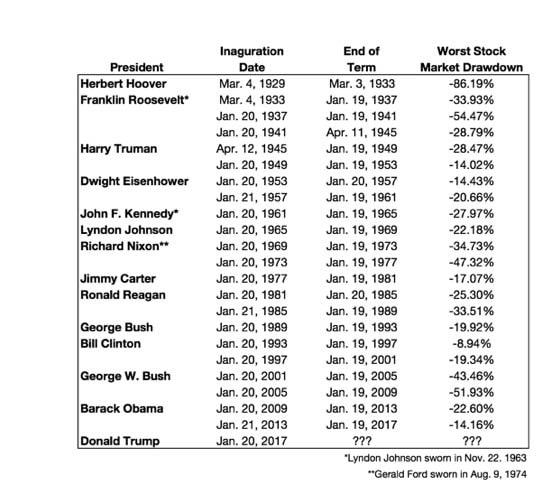

You don’t believe it? The accompanying chart shows the worst stock market drawdowns for every president since Herbert Hoover in the 1930s, and you can see that good president or bad, Republican or Democrat, they all eventually experienced significant down markets. Some might be surprised to see Ronald Reagan’s 25% and 33% drop from high to low, or the nearly 52% drawdown experienced during George W. Bush’s presidency. Weren’t these pro-business Presidents?

What the chart doesn’t show, but you know already, is that after every single one of these scary drops, the markets recovered to post new highs, which we’re experiencing today. So don’t listen to anybody who talks about “if” the markets are eventually going to go down sometime in the next four years. We’re going to experience a bear market—time, date, duration and extent unknown. And then, if history is any indication, we’ll see new highs again eventually.

So with the thought that we have a Bear Market approaching what is the best thing a long term investor should do? If your portfolio is well balanced and it is balanced for withdrawals in the near term, the best answer is nothing! Yes, as hard and surprising as that sounds, history proves that for the vast majority of portfolios riding out the drop and reinvesting is the best thing to do to weather and prosper during Bear Markets.  Source: www.bloomberg

Source: www.bloomberg