Many of the recent news reports indicate home price increases across the country, especially in areas hit the hardest such as the southwest. Mortgage payments are now more reasonable in comparison to rising rents. This produces a perception of affordability for the housing market, allowing more people to enter the market and propping up home prices.

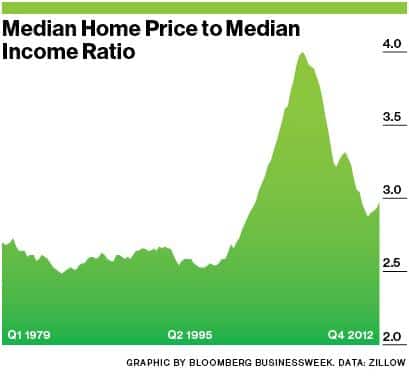

However, artificially low interest rates have spurred much of the activity. While on the surface this may seem beneficial to the economy, there are still underlying fundamentals that are point to further need for home prices to correct. The median home price to median income ratio is sitting right around 3.0, which is 15% higher than the 2.6 long-term averages. Further corrections in the residential housing markets could be lurking before we see prices stabilize through normalized supply and demand.

Should this correction occur, we think the impact to banks will be significantly less severe than what we witnessed in 2008 – 2009. Overall it will be a minor impact to their profitability. Practically all of the highly leverage loans have flushed through the system. Those who refinanced or purchased in the past 4 -5 years are strong borrowers and have sufficient equity in place to weather a price decrease. Those who are already underwater will be forced to stay in their homes and an unfortunate few will need to foreclosure or enter a short sale. The interesting part is that the areas with high investor purchased homes will once again witness the greatest drop in values and those areas are the same as occurred in 2008. Some investors never learn!

Source: