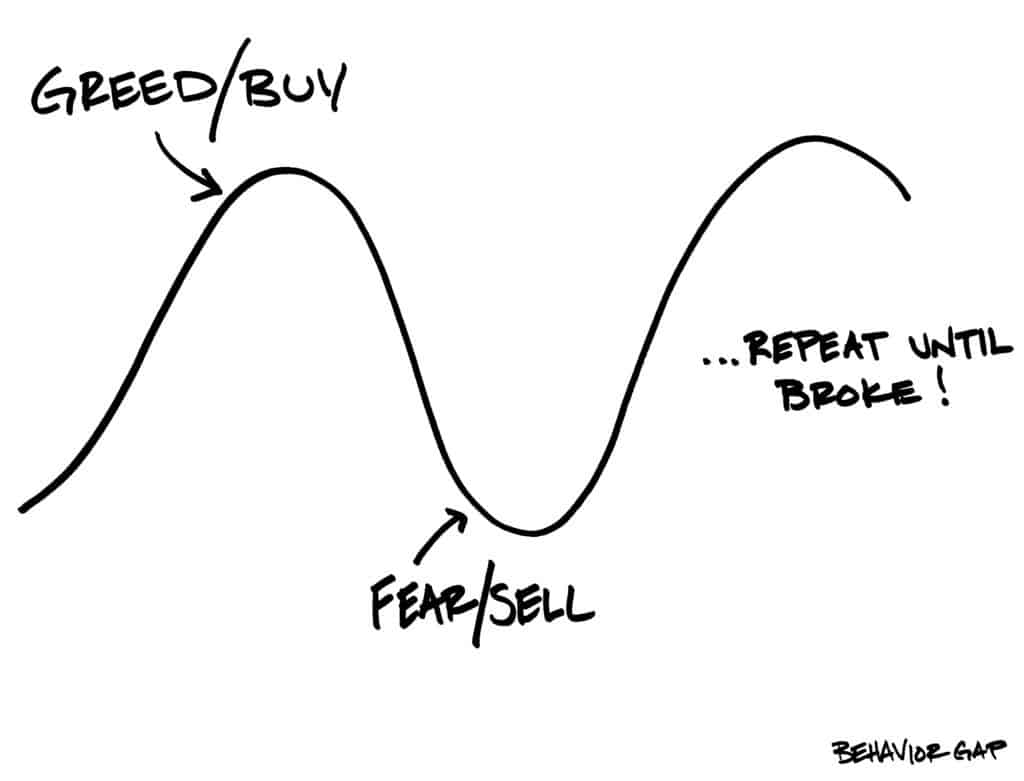

At Colman Knight, we often discuss a fundamental truth about financial markets that many find challenging: markets provoke emotional responses in nearly everyone. Whether it’s FOMO (fear of missing out) during rising markets or fear of loss and regret during declines, our emotional reactions to market fluctuations are deeply tied to our sense of security and sufficiency.

Understanding Our Emotional Response to Markets

The relationship between our emotions and the market runs deeper than many realize. Market fluctuations trigger responses based on how well we’re centered in our sense of “enough” – what we prefer to call sufficiency. While it might seem repetitive to hear messages about being “OK” and feeling “safe,” recent advances in brain science provide compelling evidence for why managing these emotional responses is crucial to successful wealth management.

The Science Behind Financial Decision-Making

Our nervous system carries powerful messages to our brain about survival. When markets fluctuate, these ancient circuits can trigger fear responses – fight, flee, freeze, or faint. Each of us activates our unique fear pattern:

- Some mobilize through fight or flee responses

- Others immobilize through freeze or faint reactions

- Most experience a combination of these responses

This biological reality can lead us into cycles of “futurizing” and “awfulizing” – creating worry about future scenarios that haven’t happened yet. Our brain, trying to protect us, generates survival thoughts and strategies to solve these imagined future problems.

Finding Your Center: The Practice of Sufficiency

The most effective path to clear financial decision-making lies in recognizing your “OKness” in the present moment and practicing what we call “embodied sufficiency.” This means:

Understanding that sufficiency is:

- The recognition that you are OK right now

- The awareness that you have what you need in this moment

- A state of being that can be cultivated and strengthened

This practice helps calm your nervous system and promotes the release of beneficial chemicals that shift your brain state from fear to presence.

Practical Tools for Emotional Balance

When market fluctuations trigger fear or anxiety, try these grounding practices:

- Deep Breathing Take fuller, deeper breaths into your belly that engage your entire body. Allow you exhale to be longer than your inhale. Mindful breathing signals safety to your nervous system.

- Physical Grounding Feel your feet firmly touching the floor or take time to sit on the ground. Physical connections remind your body that you’re stable and secure.

- Present Moment Awareness Notice that at this moment, you are okay. Your body is breathing, your heart is beating, you are here safe and capable.

The Integral Approach to Investment Management

At Colman Knight, our holistic financial planning approach integrates these emotional and psychological insights with sound investment strategies. We help you:

- Recognize emotional patterns in your financial decision-making

- Develop practices for maintaining perspective during market volatility

- Create investment strategies that align with both your financial goals and emotional comfort

- Build confidence in your long-term financial plan

- Integrate your investment management with what matters most to you and your life aspirations.

Creating Sustainable Financial Well-being

True financial well-being comes from balancing technical expertise with emotional intelligence. This means:

- Understanding that market changes are normal and expected

- Developing tools to navigage emotional responses to financial ups and downs

- Creating investment strategies that you can sustain through market cycles

- Building a financial plan that considers both your financial and emotional needs

The Value of Professional Guidance

Having a trusted advisor during times of market volatility can make the difference between reactive decisions and thoughtful choices. Our role includes:

- Providing perspective during emotional market periods

- Helping maintain focus on long-term objectives

- Offering tools and practices for emotional regulation

- Supporting confident decision-making aligned with your goals

Moving Forward with Confidence

Understanding the interplay between market behavior and human psychology is crucial for long-term financial success. At Colman Knight, we’re committed to helping you develop both the practical skills and emotional resilience needed for sustainable wealth management.

Ready to explore a more balanced approach to investment management? Contact us to learn how our holistic financial planning services can help you navigate market challenges with greater confidence and clarity.