Welcome back to our weekly market recap. Before we get to it, let me say that I look forward to being back on video next week. Over the past two weekends I have had a couple of trips—to Chicago to celebrate Passover with my girlfriend’s family, and a wedding in Charlotte, NC this weekend. I look forward to returning to my normal schedule and preferred format!

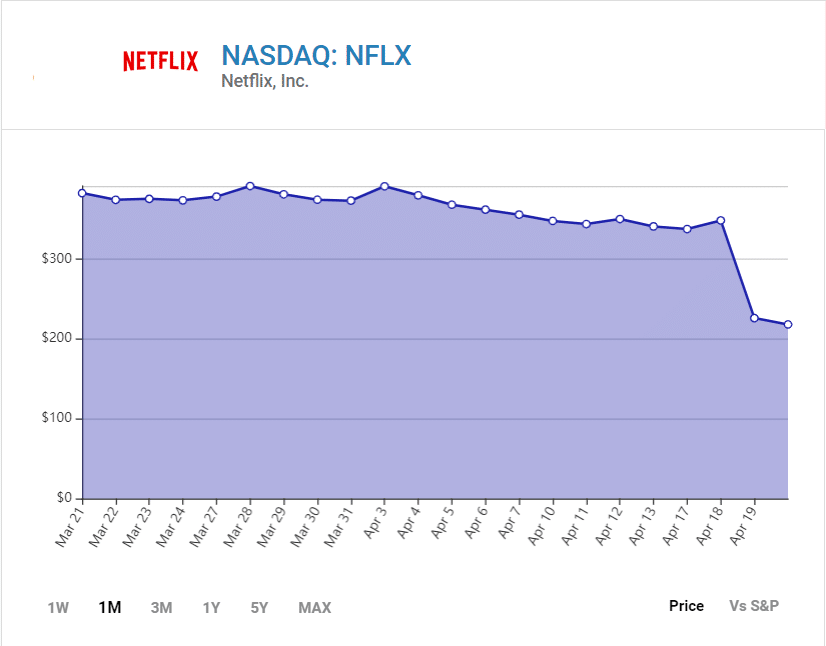

Netflix’ earnings report and its fallout captured all the headlines this week. Its stock fell 35%. Their report showed that revenue slightly missed, but earnings per share beat expectations. The pain of the matter came from analysts’ major miscue. They expected the Netflix subscriber count to increase by 2.5 million—instead, Netflix lost around 200,000 subscribers. It was a miss by more than 2 million individuals.

The logical question is: why is this so detrimental for Netflix, which made more money last quarter than in any of the previous three? The answer: Netflix is priced as a growth company, which tend to be young companies projected to grow rapidly over the years. Investors are partially paying for the current profits and/or dividends, but mostly, they are investing for much higher future profits.

With these expectations, investors tend to be willing to pay a higher multiple—this means they are willing to pay a higher price for this company’s stock than it may appear to be worth today, than for a company’s stock that is not expected to grow as much in the future and whose worth is derived solely on today’s earnings.

Back in November, Netflix had a price of $690/share, and a P/E (price-to-earnings) ratio of around 55. Today, Netflix has a price of $217 and a P/E ratio of around 19. When a company has built up expectations to grow significantly and is no longer growing, we see a very painful correction in the stock price. Investors are no longer willing to pay such high multiples for a company that cannot grow.

Netflix might have captured the attention of the market, but I was more interested in the earnings of Proctor and Gamble. In particular, their report’s forward guidance about the consumer.

P&G revised sales UP for the rest of the year. Even better, they report that their highest demand is deriving from their more luxury products. People are spending more for the fragrance-free, higher-end diapers. Demand is strongest for the most expensive products. This matters, because it shows that the consumer is still strong. During a recession, demand spikes for the lower-end products and falls dramatically for the higher-cost items. P&G’s report depicts a strong consumer in Q1 of 2022 AND they expect that to continue throughout the year, even with future price increases for P&G in July.

Looking forward, we are still in the midst of earnings season, and there is a lot left to digest. The other big catalysts coming up are: the Fed meeting on May 4—will they raise the prime rate 0.25% or 0.5%; the next CPI (consumer priced index) reading May 11: will core inflation continue to trend down; and May 9 – Victory Day—will we see an end to the conflict in Ukraine. We will be watching these events unfold and talking with you about their effects on the market.

Sincerely,

| Knight Colman, CFP®

In Service of Client Financial Flows and Planning at Colman Knight |