Investment professionals with long memories can remember the olden days when the investment markets and the U.S. economy were not – and were not supposed to be – controlled, rigged or otherwise directly manipulated by the U.S. central bank. But we are far from that today, as evidenced by the market reaction to Federal Reserve Board Chairperson Janet Yellen’s press conference, and the release of the minutes of the Fed’s most recent Federal Open Market Committee (FOMC) meeting. By the end of the day on March 18th, the Standard & Poor’s 500 index had dropped 0.61 percent, the Nasdaq Composite slipped 0.59 percent, and there was an immediate sell-off in Treasury securities. Hardest hit were 4-5 year yields, where rates rose 0.12%.

Despite all the breathless reporting, what Yellen actually said was pretty mild. She (and the FOMC minutes) noted that the U.S. unemployment rate is falling faster than expected – which has to be considered good news for the economy. She noted that inflation is low – which is certainly not terrible news. Yellen told the gathered reporters that the Fed is now cutting back on its purchases of Treasury bonds and packages of home mortgages, from $65 billion a month to $55 billion, which means that our central bank will still be the largest buyer at the table by orders of magnitude, and still be setting rates as the loudest voice at auction.

Toward the end of her remarks, Yellen said that the Fed hopes to bring unemployment down to somewhere between 5.2% and 5.6% (which, for some reason is described as “full” employment), and the Fed’s economists seem to expect that this will happen in the next year or two. How can that be bad news?

Why are people abandoning stocks? While Yellen said that she expects the Fed to continue to keep interest rates low, she also told the group that with the unemployment rate at around 6.7% currently, the Fed will no longer view a 6.5% unemployment rate as its signal to end its stimulus measures. That suggested, to some observers, that the Fed will allow interest rates to rise next year, and indeed, the FOMC minutes show that 13 of the Fed’s 16 policy makers expect that the U.S. central bank will start allowing interest rates to find their natural levels sometime in 2015. (Two other Fed economists expect the Fed to take its foot off of rates sometime in 2016.)

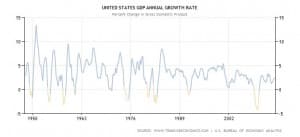

It is fair to wonder why these mild forecasts and statements rocked the markets, but a bigger question is whether the markets actually need the Fed’s heavy-handed intervention at this point in the long recovery from 2008-2009. The U.S. economy grew 3.2% in the fourth quarter of 2013, and growth hit 2.7% for the year. Since 1948, the average yearly growth rate of the U.S. economy has been 3.21%, which suggests that our economic engine no longer needs a loud buyer at the auction table to prop it up. Meanwhile, the stock market has been testing new highs since the bottom in March 2009.

Perhaps most importantly, there is no evidence that the Fed’s economists – brilliant people all – have the knowledge or insight to forecast and control our economic cycles.

The only real significance of the press conference is that it takes us one step closer to the day when Chairperson Yellen will announce that the Fed is no longer in the business of buying billions of dollars’ worth of the bonds issued by its own government and quasi-government entities. When that day comes, the economy and the markets are going to have to figure out how to operate without an outside entity rigging prices and rates. It is possible that the wisdom of all aggregate buyers and sellers, when they finally get back control of the tiller, will do a more effective job of moving the economy forward than a handful of economists. But based on yesterday’s press conference, we won’t find that out for a couple of years at least.

Sources:

http://finance.yahoo.com/news/yellen-fed-poised-trim-bond-050257961.html

http://finance.yahoo.com/news/stock-futures-little-changed-two-111210499.html

http://finance.yahoo.com/news/live-janet-yellens-first-fomc-183202472.html

http://www.businessinsider.com/march-fomc-statement-2014-3

http://www.tradingeconomics.com/united-states/gdp-growth-annual