You’ve probably heard economists and especially wise investors say something like “short-term, the stock market is like a voting machine, but long-term it acts like a weighing machine”–a quote attributed to legendary value investor Benjamin Graham. But what does that mean and how does it apply to your investment portfolio?

The quote basically means that the short-term movements of the markets tend to be based on subjective or emotional judgments, rather than any actual change in the value of the securities being traded. In fact, you can be amused if you look for examples where the economic pundits say that the markets went up one day because of a positive government economic report, and then a few days later they will ay the markets went down because the government’s positive outlook might mean that the Fed will taper faster than planned. It is not uncommon for the same type of event to be blamed for a market decline and cited in a market rise within days of each other.

Longer-term, however, the quote says the markets are driven by something different: gradual changes in the underlying value of the securities being traded. As a company’s earnings grow, incrementally over time, as its profits grow, as its business expands, it becomes more valuable. None of this shows up in today’s trading, but over the years, the rise in value becomes visible.

There are many genuinely valuable lessons in the quote. One is that it is better for your financial well-being to ignore the flighty short-term events and focus on the more durable longer-term trends. Another, more fundamental point is that whenever you buy a representative basket of stocks, you are participating in the growth of the underlying businesses and the economy as a whole. That means that when millions of workers toil away at the office for days and weeks on end, creating value, building enterprises, coming up with new ideas, building and making and creating, you, too, are participating in the fruits of their labor. The effect is gradual, but clearly visible if you can look at the longer-term impact on your investments.

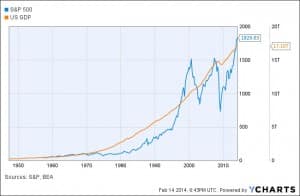

If you look at the graph below, you can see the growth of the U.S. economy since 1950 (orange line), from less than $1 trillion in economic activity to more than $17 trillion today. American workers, in aggregate, appear to have worked wonders in terms of total value creation. Notice, in passing, the small dip in late 2008 to the middle of 2009, which represents the recent near-collapse of the global economy. Seen in broad perspective, it looks almost like a non-event.

The same graph shows the rise in value of the Standard & Poor’s 500 index (blue line), which is a group of companies that comprise much of the U.S. economic activity. You can clearly see that the blue line will sometimes grow more slowly than the underlying economics, and then will grow faster, and fall back, and grow back again. But overall, the market always seems to return to the very same growth pattern as the economy as a whole. This is the “weighing machine” aspect of the markets, the fact that people eventually notice whenever the markets are priced higher than the underlying value, or lower. It can take years, but eventually real value asserts itself over short-term emotional responses.

This graph doesn’t tell us whether stocks are overvalued or undervalued today; nor, really, will anything or anybody tell us that with any certainty. The important thing to focus on is the growth. That’s why we invest; to capture that long-term growth, which means taking on some setbacks along the way when the flighty participants in the voting machine can’t see past the short-term dangers to the longer-term opportunities.