In 1945, the U.S. made up more than half of the world’s total gross domestic product (GDP), which basically means that half the world’s economy took place inside U.S. borders. Today that figure is just under 22%.

Does that mean America is in decline?

There seems to be a bull market in doomsayers these past few years, as we’re all reading arguments that the U.S. is slowly losing its grip on global preeminence. The rhetoric today sounds a lot like the hand-wringing back in the 1980s when Japan was allegedly taking over the global economy, and before that, when the Soviet Union had more missiles and a Sputnik circling over our heads.

There’s no easy way to define the overall quality of an economy, but probably the most thorough assessment comes out each year via the World Economic Forum’s Global Competitiveness Rankings. The most recent report ranked 144 countries around the world, including Qatar (16), Moldavia (82), Namibia (88), Lesotho (107) and the unhappy states of Chad (143) and Guinea (144), whose citizens eke out their lives on per capita incomes of $1,218 and $564 a year, respectively.

The survey looks at 12 “pillars” of economic competitiveness, including labor market efficiency, the quality of primary education and higher education, infrastructure, the strength of institutions, innovation, business sophistication, technological readiness and the sophistication of the financial markets. Each of these categories are broken down into dozens of subcategories, which are separately evaluated. For instance, when looking at the strength of each country’s public institutions, the World Economic Forum researchers consider whether people in a given country have strong property rights and intellectual property protection, whether there is corruption and the routine payment of bribes, whether the citizens enjoy judicial independence and a solid legal framework, and how well investors enjoy shareholder protection.

In the most recent survey, the U.S. ranked third overall, with an overall rating of 5.5 on a scale of 1-6. Ahead of it were Switzerland (5.7) and Singapore (5.6). China, the country that you most often hear cited as the all-powerful up-and-coming economy, ranked 28th, two rungs below Saudi Arabia, one rung above Estonia. Brazil and India, which are sometimes mentioned as powerful competitors to U.S. economic hegemony, are ranked 57th and 71st, respectively.

The point of the rankings is to show which countries have created the healthiest (or, in the cases of Chad and Guinea, the least-healthy) economic climate for future growth. But of course there are other ways of measuring competitiveness, including the bottom line (as mentioned at the top of the article) of percentage of the world GDP, and whether you’re moving up or down.

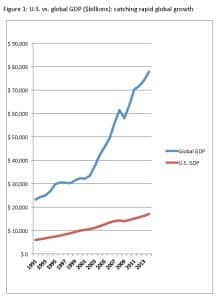

By that standard, the U.S. is indeed moving down. If you look at Figure 1, which shows the size of the overall global and U.S. economies since 1991, you see that the U.S. has enjoyed steady economic growth, while the world at large has essentially taken off like a rocket. The years following the collapse of the Soviet Union, when several billion people were suddenly allowed to become capitalists, have been good for world growth. When China shifted from a communist to a capitalist economic posture, this added fuel to the rocket. The democratization of computer technology and the global Internet has empowered value creators everywhere.

The U.S., Europe and Japan, in other words, no longer have a monopoly on capitalism. And that’s a good thing.

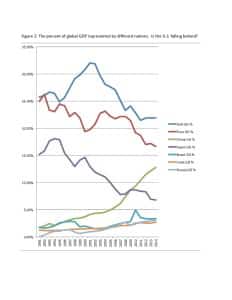

Is there a better way of evaluating how the U.S. economy is holding up in an increasingly competitive world? Figure 2 looks at the first chart from a slightly different angle. Since 1991, what percentage of all the world’s business has been happening in the U.S., vs. Europe, Japan, China, India, Russia and Brazil? How much of the total global economy did each nation claim in each year, and how has that balance changed over time?

What you see there is that the U.S. is still in the lead by a pretty wide margin, and in recent years has actually stabilized its percentage of total global GDP. The decline has come mostly because a lot of smaller emerging markets, plus China and, to a certain extent, Brazil, India and Russia, have all been growing. At the same time, America’s traditional competitors—Europe and Japan—have been sinking. If you want to point a finger at decline, perhaps that’s a better direction than the U.S.

Does the U.S. face economic challenges? Of course. Is our political system a mess? Sure. Could things be better? Certainly. But if you sift through a lot of variables with a fine-toothed comb, you discover that the U.S. has created a better environment to grow and prosper than almost anywhere else, and it has held its own with the roaring growth of the emerging markets while the other developed nations are losing ground. More than a fifth of all economic activity still happens in the U.S., and the long, slow decline in that figure is not due to stagnation at home, but abundant growth all around the world. That’s not something to worry about; it’s something we should be celebrating.

Sources:

http://www.economywatch.com/economic-statistics/year/1990/

http://theamericanscene.com/2008/05/07/a-post-american-world