Changes in Social Security and Taxes

October 15 marked the end of the 2020 tax year, and Shaohui and Rich can release the deadline tension for a few months. Meanwhile, they hit the books and tune in to tax law and other changes for 2021.

In this newsletter:

- Social Security benefits increase

- Tax inflation adjustments for tax year 2021

- How proposed changes in “Biden Tax Plan” could affect you

From the Professor,

Rich Colman:

For 2021, the most dramatic change we’re noting is the increase in Social Security benefits by 5.9%

The last time Social Security benefits increased at a greater rate was the 7.4% increase in 1982 when then Federal Reserve president Paul Volker raised interest rates to double-digits, to combat inflation. We believe the 2023 rate may also be high, as the current inflation reflects the supply disruptions and demands for goods generated by the pandemic. Social Security benefit rate increases almost always are backward-looking, as the rate increases lag inflation.

A 2021 study from the Social Security Administration shows somewhere between 14-26% of Social Security recipients depend upon Social Security for 90% or more of their total income. The range is rather large, but when data is corroborated with IRS data, the amount is 14% and when data is based upon recipient households reporting their own retirement income, the percentage of households reporting 90% of income increases by almost 100%. This difference has been noted by recording discrepancies between households’ ability to report, and IRS data from tax returns. It is believed that the most accurate report is the one generated by the IRS. Somehow that does not surprise us.

From the Tax Brain,

Shaohui Li:

Inflation changes and proposed “Biden Tax Plan”

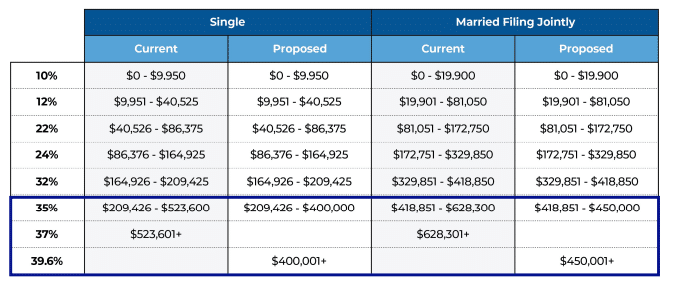

As with every year, the IRS provides tax inflation adjustments to tax brackets, standard deduction, retirement contributions, etc. This year we are faced with more uncertainty with the new administration’s pending tax law changes: the “Biden Tax Plan.” The most current proposed tax plan is the list of tax provisions released by the House Ways and Means Committee on September 13.

One of the important items to note is the increased marriage penalty under the Biden tax proposal. Single individuals have a $400,000 threshold before they are in the highest bracket and in 2021 the bracket for married couples is approximately twice as high as for singles. Under the Biden proposal married couples pay the highest bracket when they earn $50,000 more than single filers (a rather steep marriage penalty).

Ordinary Income Tax Rates Effective 1/1/2021, compared side-by-side with proposed tax bill (as of September 13.)

© 2021 Kitces.com

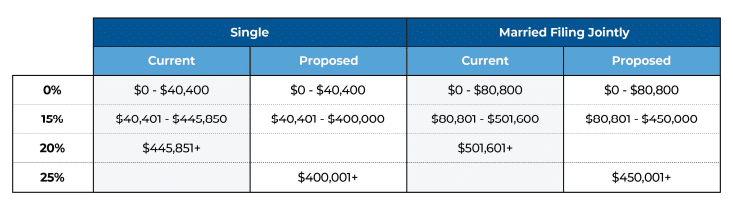

Capital Gains Tax Rates compared side-by-side with proposed tax bill (as of September 13.)

© 2021 Kitces.com

Other 2021 items and changes:

– The standard deduction for married couples filing jointly, for tax year 2021, rises to $25,100, up $300 from 2020. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard deduction will be $18,800 for tax year 2021, up $150.

– Required minimum distributions (RMDs) are back for 2021. Seniors were allowed to skip their RMDs in 2020 without having to pay a penalty. Anyone who is at least 72 years old by the end the year is required to take an RMD for 2021.

– Maximum contribution limits for 401(k), 403(b) and 457 plans stay at $19,500, while people born before 1972 can put in $6,500 more as a “catch-up” contribution. The 2021 cap on contributions to SIMPLE IRAs also stays the same at $13,500, plus an extra $3,000 for people age 50 and up.

– The 2021 contribution limit for traditional IRAs and Roth IRAs also stays steady at $6,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and up.

– Estates of decedents who die during 2021 have a basic exclusion amount of $11,700,000, up from a total of $11,580,000 for estates of decedents who died in 2020.

– The annual exclusion for gifts is $15,000 for calendar year 2021, as it was for calendar year 2020.

– For the 2020 tax year, a new “above-the-line” deduction was allowed for up to $300 of charitable cash contributions for people who claimed the standard deduction on their tax return (rather than claiming itemized deductions on Schedule A). For 2021, one deduction is allowed per person, which means married couples can deduct up to $600 on a joint 2021 tax return.

– The 2020 suspension of the 60%-of-AGI limit on deductions for cash donations by people who itemize was also extended through the 2021 tax year.

Other proposed changes by the House Ways and Means Committee for “Biden Tax Plan”:

As of this moment, we are not certain about which of the proposed changes will become final. We will keep monitoring the changes and provide more insights as they become available.

– The proposal would expand the Sec. 1411 net investment income tax to cover net investment income derived in the ordinary course of a trade or business for taxpayers with greater than $400,000 in taxable income (single filers) or $500,000 (joint filers), as well as for trusts and estates.

– Qualified business income deduction: The proposal would set the maximum allowable deduction under Sec. 199A at $500,000 in the case of a joint return, $400,000 for an individual return, $250,000 for a married individual filing a separate return, and $10,000 for a trust or estate.

– The proposal would amend Sec. 461(l) to permanently disallow excess business losses (i.e., net business deductions in excess of business income) for noncorporate taxpayers. Here the Biden proposal is more generous to Corporations which get to keep their deduction, than small businesses.

– High-income surcharge: The proposal would impose a tax equal to 3% of a taxpayer’s modified AGI (MAGI) in excess of $5 million.

– For high-income taxpayers, the proposal would prohibit further contributions to a Roth or traditional IRA for a tax year if the total value of an individual’s IRA and defined contribution retirement accounts generally exceeds $10 million as of the end of the prior tax year.

– For high-income taxpayers whose combined traditional IRA, Roth IRA, and defined contribution retirement account balances generally exceed $10 million at the end of a tax year, a required minimum distribution would be required for the following year.

– The proposal would eliminate Roth conversions for both IRAs and employer-sponsored plans for single taxpayers (or taxpayers married filing separately) with taxable income over $400,000, married taxpayers filing jointly with taxable income over $450,000, and heads of household with taxable income over $425,000 (all indexed for inflation).

– The proposal would replace the current flat 21% corporate tax rate with a graduated rate, starting at 18% on the first $400,000 of income; 21% on income up to $5 million; and 26.5% on income above $5 million. However, the graduated rate would phase out for corporations making more than $10 million.

Resources:

• https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2021

• https://www.kiplinger.com/taxes/tax-law/603037/tax-changes-and-key-amounts-for-the-2021-tax-year

• https://www.journalofaccountancy.com/news/2021/sep/tax-provisions-budget-bill-build-america-back-better.html