The important factors to consider about retirement, or life as you dynamically live and experience satisfaction, pleasure and purpose, are:

Regarding health, being unhealthy (needing medical care) is very expensive. There are deductibles, co-pays, parking costs, medications that consume resources. Someone may need nursing care and/or drivers. Presently, my parents (Gayle) age 89 and 86, enjoy at least one medical visit per week. It is their primary form of entertainment and activity. These appointments cost money. It is quoted that 80% of health care costs are expended in the last two and a half years of life. A 2016 Medicare study reports that Medicare benefits paid on average about $10,000 per recipient; but that amount jumps to more than $34,000 for Medicare recipients age 80 and older during the year they die. The same Medicare study found that over 55% of Medicare recipients who die are now 80 and over. An AARP study describes how a 65-year-old couple will expend $240,000 for out of pocket costs excluding long term care costs through their retirement.

Regarding location, residing (and retiring) in Boston, San Francisco, or New York City requires more assets than a person settling in a small town located in Kentucky, South Dakota or Wisconsin. Location plays a large role, as does the lifestyle of where you live. How large is your home? How often do you eat meals at a restaurant? Where do you spend your leisure time? Are you engaged in activities that consume money or generate money?

Regarding aging, there is a natural aging process; we are all aging from the time we reach peak ages for men as follows: of 18 for sexual prowess (sorry guys), 19 for problem solving, 22 for endurance, 28 for memory, 30 for muscle mass, 32 for relationships (not sure what this means) and finally, at age 45 brain cells peak. For women the scenario is entirely different, their peak ages are: 35 for sexual prowess (this explains Mrs. Robinson and the Cougar effect), 39 for problem solving, 34 for endurance, 39 for memory, 30 for muscle mass, 51 for relationships and 26 for brain cells (their brains are too busy worrying/caring for others – which is why 51 for relationships!). But our bodies do not begin to show signs of aging until we are beyond 50. And how we age is dependent upon genes and lifestyle. A person in his or her sixties or seventies will typically spend more on activities such as travel and entertainment than someone in their 80’s or 90’s.

Regarding our family and philanthropic intent, some choose to maintain wealth for the next generation and meaningful issues for charity. Some choose to give away wealth in the present. Some choose to “die broke” as suggested by Stephen Pollan and Mark Levin, authors of “Die Broke: A Radical Four-Part Financial Plan”. Obviously, the more you want to leave behind or give away, the less you are able to spend while you are alive.

Lastly, the question of what matters most to you and how to manifest that reality can never be answered by a number. This is the crucial point of all retirement calculations offered by institutions, unskilled financial advisors, robo-calculators and professors who teach quants. In order to experience retirement, or a dynamically satisfying life at every stage, you must engage conversation about what really matters TO YOU and allow those unique and meaningful objectives drive the decisions you make with your financial resources. Generalized figures are meaningless and harmful. You may be prepared and have saved the numbers suggested only to realize that you don’t have enough based upon a factor not considered. Or, you may be financially prepared but the numbers suggest otherwise; in this situation, you endure fear and generate a negative mind-state about your ability to live comfortably.

Do not be fooled by general numbers, averages and reports from outside sources. Unless you are met closely and engage in dialogue about your personal situation, the answers offered by unknown sources will be wrong. And, unless you engage in conversation regularly about what is happening in your life, as everything continues to grow, evolve and change, your answers will be from the past, rather than present.

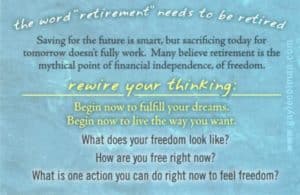

As a friendly reminder, pull out your Try-Rewirement MoneyMove® card.

It asks you to rewire your thinking:

Begin now to fulfill your dreams.

Begin now to live the way you want.

What does your freedom look like?

How are you free right now?

What is one action you can do right now to feel freedom?