Spanish leaders recently requested economic assistance from the European Union’s central bank (ECB), a few days after the Fitch Ratings service dropped the debt rating on Spanish government bonds to BBB status (just above junk status). The bond markets at first responded with some alarm fearing another Greek-like tragedy of austerity measures and protracted negotiations for aid. Fortunately, this round of help for Spain was much less painful. Spain received a rescue package up to $125 billion. The after-effects in the market so far have been cautiously positive both abroad and in the U.S. stock market. But to put this downgrade into perspective, Fitch has also assigned a BBB rating to the latest bonds issued by the Time Warner Company, which is not, last time anybody checked, facing impending bankruptcy. Fitch also assigns a BBB bond rating to the nations of Brazil, India and South Africa.

Spanish leaders recently requested economic assistance from the European Union’s central bank (ECB), a few days after the Fitch Ratings service dropped the debt rating on Spanish government bonds to BBB status (just above junk status). The bond markets at first responded with some alarm fearing another Greek-like tragedy of austerity measures and protracted negotiations for aid. Fortunately, this round of help for Spain was much less painful. Spain received a rescue package up to $125 billion. The after-effects in the market so far have been cautiously positive both abroad and in the U.S. stock market. But to put this downgrade into perspective, Fitch has also assigned a BBB rating to the latest bonds issued by the Time Warner Company, which is not, last time anybody checked, facing impending bankruptcy. Fitch also assigns a BBB bond rating to the nations of Brazil, India and South Africa.

But that doesn’t mean Spain is out of the woods from an economic perspective. The International Monetary Fund will issued a report saying that the Spanish banking system needs an infusion of between $50 billion and $112.5 billion (40-90 billion euros) to restore full solvency. The amount promised is about 100 billion Euros or $125 billion. Spain’s unemployment rate is just over three times the U.S. rate – around 24.3% overall, and 51.5% of people under age 25 are unemployed – and the country may already be experiencing a recession that is probably destined to last two years at least. So the unemployment rate will not drop soon!

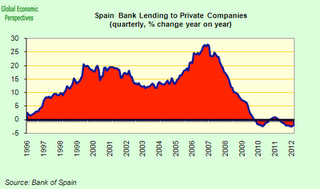

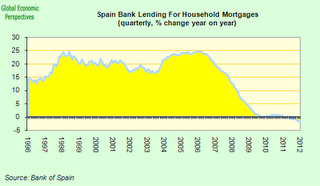

Most of us remember what happened in the U.S. during the Great Recession: the banking system locked up, shutting off corporate access to credit. The two charts below show that this may be at the root of Spain’s problems right now. The red graph shows that bank lending to Spain’s corporate sector has fluctuated between 0% and negative territory since late 2009. The yellow graph shows that lending to would-be home buyers has dried up completely. Not surprisingly, Spain’s real estate prices have collapsed and housing prices have fallen roughly 25% since 2008. Even if a million young families wanted to scoop up some of the bargains, where would they find the financing?

Seen from this standpoint, the first order of business in Spain, just like the U.S. back in 2008, is to get the banking system back on its feet, credit flowing again, people buying houses and companies investing in the kind of growth that will make a dent in that frightening unemployment rate. As you read the dire headlines, and the need for the European Financial Stability Facility to lend up to 100 billion euros to Spain’s lenders, notice somewhere toward the bottom of the story that the European Union has already set aside 440 billion euros in its bailout mechanism. Because of that, the Euro zone will not repeat the Greek Tragedy. The money is already there and fortunately none of it is coming out of the pockets of U.S. taxpayers. However, let’s be real. It is now almost halfway through 2012, the crisis in the US started about 4 years ago and we are still not where we were economically before the crisis. Most likely, the Euro zone will not do well for many years to come.

Sources:

http://www.msnbc.msn.com/id/47734525/ns/business-world_business/#.T9IhwfEii8Y

http://www.guardian.co.uk/business/2012/jun/08/eurozone-crisis-germany-suffers-imports

http://www.bbc.co.uk/news/business-18368024

http://www.bbc.co.uk/news/world-europe-18338616