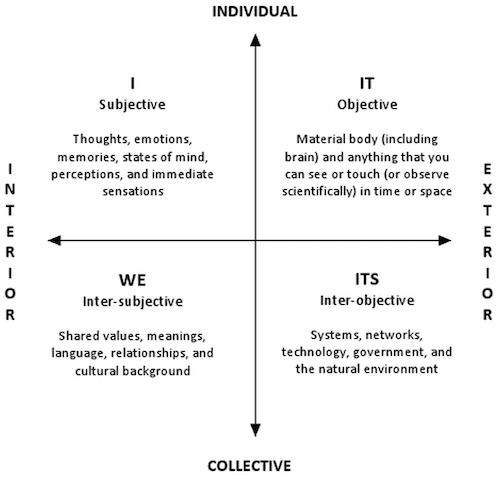

Our Integral Wealth approach stems from a developmental framework called AQAL (short for All Quadrants, All Levels, All, Lines, All States, All Types) originally developed by Ken Wilber and trademarked by the Integral Institute. It sounds complex, but it isn’t. Integral Wealth simply means that you are utilizing the full range of resources, both external and internal, for any situation to maximize the likelihood for success.

Exploring wealth and money from an integral perspective means that your experience includes attention and intention from multiple lenses, one of which is called quadrants. You don’t have to understand it, unless you want to. These quadrants reflect four orientations referred to as I, We, It, and Its.

The first two quadrants (I, We) delve into the invisible or interior realms such as your internal relationship to money and how you relate to others on the subject of money. This includes your feelings, beliefs and thoughts about money. Understanding this interior dimension is vital, because it directly impacts your view and choices and thus how your resources and results materialize in the world. How you relate to others regarding money impacts all of your decisions.

The second two quadrants, (It, Its) are the exterior or visible dimensions of your actual resources in the world, in the form of investments, legacy plans, asset protection, philanthropy, tax planning, etc. These are connected to the systems and processes and laws guiding each subject.

Client Perspective

As a client of Colman Knight, our mission is to partner with you along your life journey, maximizing your unique sources of wealth, enabling you to live a prosperous and meaningful life. We developed a practice that serves as a catalyst for real wealth. This practice enables our clients to appreciate themselves and their path to prosperity, vibrant health, and living in their unique genius.

An integral approach looks at wealth in relation to every aspect of a client’s life: health, retirement, income taxes, investment management, risk management, and well-being. Being integrally informed and committed, CK assists clients with the whole picture, not just limited parts.

To further illustrate this point, let’s review some definitions of more common financial advisory roles for individuals. A stock broker buys and sells securities based on a client’s request. The needs of the client are viewed in relation to how much cash the client requests from the account each year and what is the best risk-to-reward ratio for achieving gains. Brokers receive commissions based on how many trades they make, and some products may involve a larger commission than others. Brokers are not held to a fiduciary standard, i.e. they’re not required to keep their clients’ best interest in mind. They are required to maintain what is considered an appropriate risk for the client and their first loyalty is to their brokerage firm.

A money manager, or portfolio manager, receives compensation based on managing a portfolio of investments. Usually the compensation is based upon meeting certain target returns such as how well the portfolio performs in relation to a particular index. There is an incentive and a duty to help the client grow his/her portfolio. Whether the growth goals are correct for the client is secondary to meeting the targets by which the manager is compensated.

Third, insurance agents are compensated by selling insurance (a commission), and in cases where they manage assets, they usually charge a fee as a percentage of assets under management. Once again the standard of care is not a fiduciary standard where the client’s interest comes first. The actual standard is often governed by state laws because insurance products are exempt from federal regulation. Insurance agents who sell securities are regulated by either state security agencies or the Securities and Exchange Commission depending upon the size of the insurance agent’s firm. They sell insurance products from the organization(s) they are affiliated with, which may not be the best product for the client’s needs, and for retirement planning, they are biased toward annuities which are insurance products.

A wealth manager or financial advisor looks at four important interrelated components of wealth in addition to investments: risk management (insurance), taxes, estate planning, and retirement. A wealth manager ensures that all of the components are in balance, e.g. not maximizing investments while having inadequate insurance coverage, or vice versa. Compensation is most frequently calculated as a percentage of assets under management, and in some instances, commissions are also received from product sales.

So how is CK different from the described wealth manager? We take into account all aspects of life that financial wealth touches, not simply setting up goals to fund retirement, education planning and some vacations. While a good wealth manager might explore goals before devising a financial plan, we take into account how finances impact client’s whole life. Aspects such as health, well-being, free time, and family relations are a part of the framework of Integral Wealth.

For example, we pay attention to how a client’s wealth furthers well-being. Well-being is having sufficient funds to be independent, and enjoying leisure time to develop and sustain meaningful relationships with family, friends and colleagues. Well-being includes making a difference in the world, and maintaining good health or funding the support needed to shore up deficiencies in health such as a long term care policy. Well-being includes the areas of a client’s unique life that matter to him or her or them. While many areas are similar, some areas are impeccably unique that only a firm holding our perspective and intention can fully meet the situation and the client.

We believe in what we do, who we are, and an integral approach: providing our clients with unbiased wisdom held in an integral framework which supports them in all aspects of their lives.